PG EXPRESS Car Insurance powered by Standard Insurance Co.,Inc, FPG INSURANCE,MERCATILE INSURANCE AND PEOPLES GENERAL INSURANCE

Services

Service A

Comprehensive car insurance coverage, often referred to as “full coverage,” is a type of auto insurance that provides extensive protection for your vehicle beyond just basic liability coverage. Here’s an overview of what comprehensive car insurance typically includes:

- Physical Damage Coverage: Comprehensive insurance covers damage to your car caused by events other than collisions, such as theft, vandalism, fire, natural disasters (e.g., hail or floods), falling objects, and animal collisions.

- Theft Protection: If your vehicle is stolen, comprehensive insurance can help cover the cost of replacing it or making repairs if it’s recovered with damage.

- Glass Coverage: It often includes coverage for repairing or replacing your windshield and other glass components, such as windows and sunroofs.

- Personal Property Coverage: In some cases, personal belongings in your car may be covered if they’re damaged or stolen. However, this coverage usually has limitations.

- Custom Parts and Equipment: If you’ve added aftermarket parts, like a custom stereo or alloy wheels, comprehensive coverage can protect them if they’re damaged or stolen.

- Rental Car Reimbursement: Comprehensive insurance may include coverage for a rental car while your car is being repaired due to a covered claim.

- Emergency Roadside Assistance: Some policies offer roadside assistance services, such as towing, fuel delivery, and jump-starts.

- Coverage Beyond Collision: It’s important to note that comprehensive coverage is distinct from collision coverage, which pays for damage to your vehicle in the event of a collision with another car or object.

- Deductible: Like other types of insurance, comprehensive coverage typically has a deductible, which is the amount you must pay out of pocket before your insurance kicks in.

Keep in mind that comprehensive insurance is optional and is often added to a policy alongside liability and collision coverage. The cost of comprehensive insurance can vary based on factors like your car’s value, your location, and your deductible. It’s a valuable choice if you want to protect your vehicle from a wide range of non-collision risks and enjoy peace of mind while on the road.

Service B

Car insurance claims are requests made by policyholders to their insurance company to receive compensation for damages, losses, or expenses incurred due to various events, such as accidents, theft, or other covered incidents. Here’s an explanation of the car insurance claims process:

1. **Report the Incident**: The first step in making a car insurance claim is to report the incident to your insurance company as soon as possible. This typically involves contacting your insurer’s claims department by phone, online, or through a mobile app. You’ll need to provide details about the incident, including the date, time, location, and a description of what happened.

2. **Claim Investigation**: Once you report the claim, the insurance company will assign a claims adjuster to your case. The adjuster’s role is to investigate the incident, assess the damage, and determine if the claim is valid. They may interview you, examine any available evidence (such as photos or police reports), and assess the extent of the damage or injuries.

3. **Estimate and Documentation**: If your vehicle is damaged, an adjuster may work with repair shops to estimate the cost of repairs. You may need to provide additional documentation, such as repair estimates, medical bills, or police reports, depending on the nature of the claim.

4. **Claim Approval**: Once the adjuster completes their investigation and verifies the claim, the insurance company will approve the claim and the associated expenses. This may involve covering the cost of repairs, medical bills, or other eligible expenses.

5. **Deductible**: If your policy includes a deductible (an amount you must pay before the insurance company covers the rest), you’ll need to pay your deductible first. The insurance company will cover the remaining costs, up to the policy limits.

6. **Payment**: After the claim is approved and any deductible is paid, the insurance company will issue a payment to you or, in the case of vehicle repairs, directly to the repair shop. This payment should cover the costs associated with the claim, depending on your policy’s coverage limits.

7. **Repair or Replacement**: If your vehicle is damaged, you can have it repaired at a licensed repair shop, and the insurance company will cover the cost. If your car is deemed a total loss (the cost of repairs exceeds the car’s value), you’ll receive a payment based on the car’s value, minus any deductible.

8. **Resolving Injury Claims**: In cases involving injuries, the insurance company will work with healthcare providers to cover medical bills. If you were not at fault, your insurer may also seek reimbursement from the at-fault party’s insurance.

9. **Claims Closure**: Once the claim is settled and expenses are covered, the insurance company will close the claim. You may be asked to sign a release, confirming that you’re satisfied with the settlement and won’t pursue further claims related to the incident.

It’s essential to thoroughly review your insurance policy and understand the coverage and limits to ensure you receive the compensation you expect. Timely reporting and accurate documentation are critical for a smooth claims process. If you’re ever uncertain about the process, you can consult with your insurance agent or claims adjuster for guidance.

Service C

Roadside assistance is an optional feature or add-on to many car insurance policies that provides drivers with valuable support in the event of unexpected breakdowns or emergencies while on the road. Here’s an explanation of what roadside assistance car insurance typically covers and how it works:

**Coverage and Services**:

1. **Towing**: Roadside assistance typically covers the cost of towing your vehicle to the nearest repair shop or a location of your choice within a specified distance.

2. **Flat Tire Assistance**: If you have a flat tire, the service will send a professional to replace it with your spare tire. If you don’t have a spare or the tire cannot be repaired, they can tow your vehicle to a repair facility.

3. **Battery Jump-Start**: If your car’s battery is dead, roadside assistance will send someone to jump-start your vehicle. If the battery is beyond resuscitation, they may offer battery replacement services.

4. **Fuel Delivery**: If you run out of fuel, the service can provide a limited supply of gas or diesel to help you reach the nearest gas station.

5. **Lockout Services**: If you accidentally lock your keys inside your car, roadside assistance can send a locksmith to help you gain access to your vehicle.

6. **Emergency Repair Services**: Some plans may cover minor roadside repairs, such as fixing a minor mechanical issue or making temporary adjustments to get your vehicle back on the road.

7. **Winching and Extraction**: In case your vehicle is stuck in a ditch, mud, or snow, roadside assistance can send a tow truck to winch your vehicle out.

8. **Emergency Travel and Accommodation**: In the event of a major breakdown far from home, some plans may cover expenses like a rental car or accommodation while your vehicle is being repaired.

**How Roadside Assistance Works**:

1. **Contact Your Provider**: When you encounter a roadside emergency or breakdown, you need to contact your insurance provider’s designated hotline or phone number for assistance.

2. **Provide Information**: Be prepared to provide your policy details, location, and the nature of the problem. The service provider will dispatch help based on this information.

3. **Wait for Assistance**: Once assistance is on the way, you should wait at a safe location for the service provider to arrive.

4. **Receive Services**: The service provider will perform the necessary roadside assistance, whether it’s jump-starting your car, changing a flat tire, towing your vehicle, or other services as needed.

5. **Sign and Go**: In most cases, you may need to sign a form confirming the completion of the service, and you can then continue your journey.

**Benefits**:

– **Peace of Mind**: Roadside assistance offers peace of mind, knowing that help is just a phone call away in case of unexpected vehicle troubles.

– **Cost Savings**: It can save you money on towing and repair expenses, as these services can be costly when paid out of pocket.

– **Convenience**: It provides convenient solutions to common roadside issues, such as dead batteries, flat tires, and lockouts, without having to search for help.

Roadside assistance is a valuable addition to your car insurance policy, especially if you frequently drive long distances or in adverse weather conditions. The specific coverage and cost of roadside assistance can vary among insurance providers, so it’s important to review your policy to understand the details and limitations of the service.

Service D

“We make budgeting easy with 𝗜𝗡𝗦𝗧𝗔𝗟𝗟𝗠𝗘𝗡𝗧 options! Choose from 3️⃣, 4️⃣, 5️⃣, or 6️⃣-month plans. Enjoy 0% 𝗜𝗡𝗧𝗘𝗥𝗘𝗦𝗧, and we accept various payment methods for your convenience. Your financial flexibility matters to us! 📆💳 #FlexiblePayments #BudgetFriendly”

Available po tayo for 𝐈𝐍𝐒𝐓𝐀𝐋𝐋𝐌𝐄𝐍𝐓 ✔️✔️✔️

𝟑, 𝟒, 𝟓, 𝟔, 𝘔𝘖𝘕𝘛𝘏𝘚 ✔️✔️✔️

𝟬% 𝗜𝗡𝗧𝗘𝗥𝗘𝗦𝗧 po tyo ☺️☺️☺️

𝐖𝐞 𝐚𝐜𝐜𝐞𝐩𝐭 👇👇👇

✔️ 6 months to pay=𝘊𝘙𝘌𝘋𝘐𝘛 𝘊𝘈𝘙𝘋 (Bpi, Bdo, Metrobank, Hsbc, Citibank and Rcbc)

✔️ 6 months=POSTDATED CHECK

✔️ 4 months=BANK TRANSFER

✔️ 4 months=BANK DEPOSIT

✔️ 4 months=𝘎𝘊𝘈𝘚𝘏

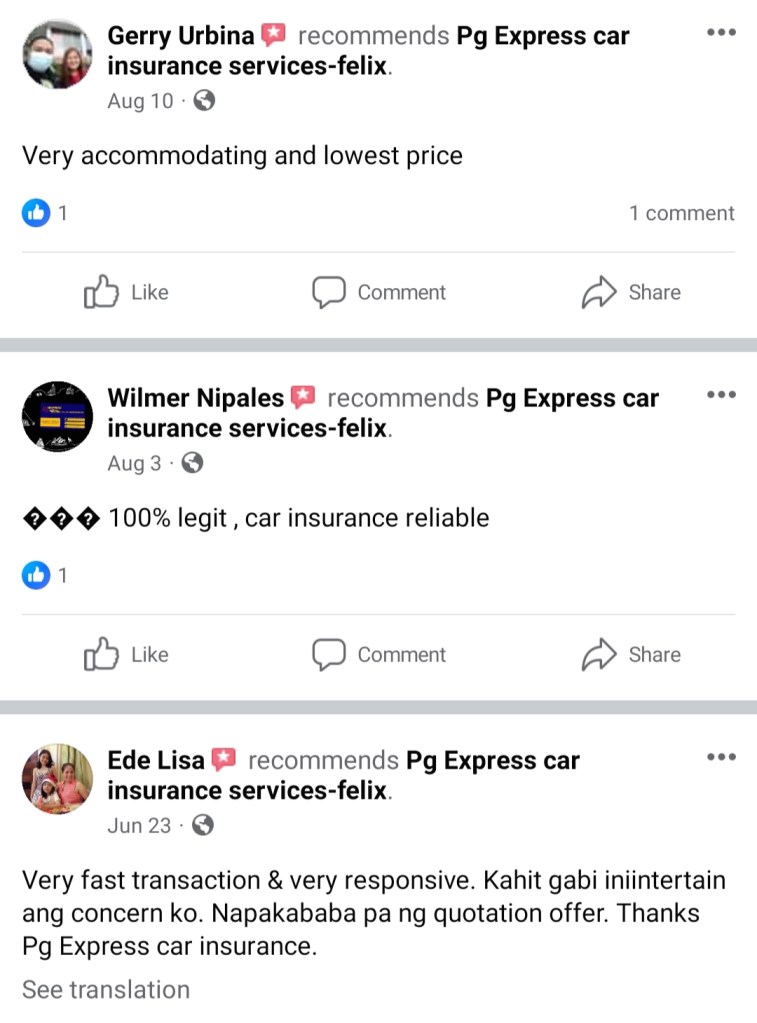

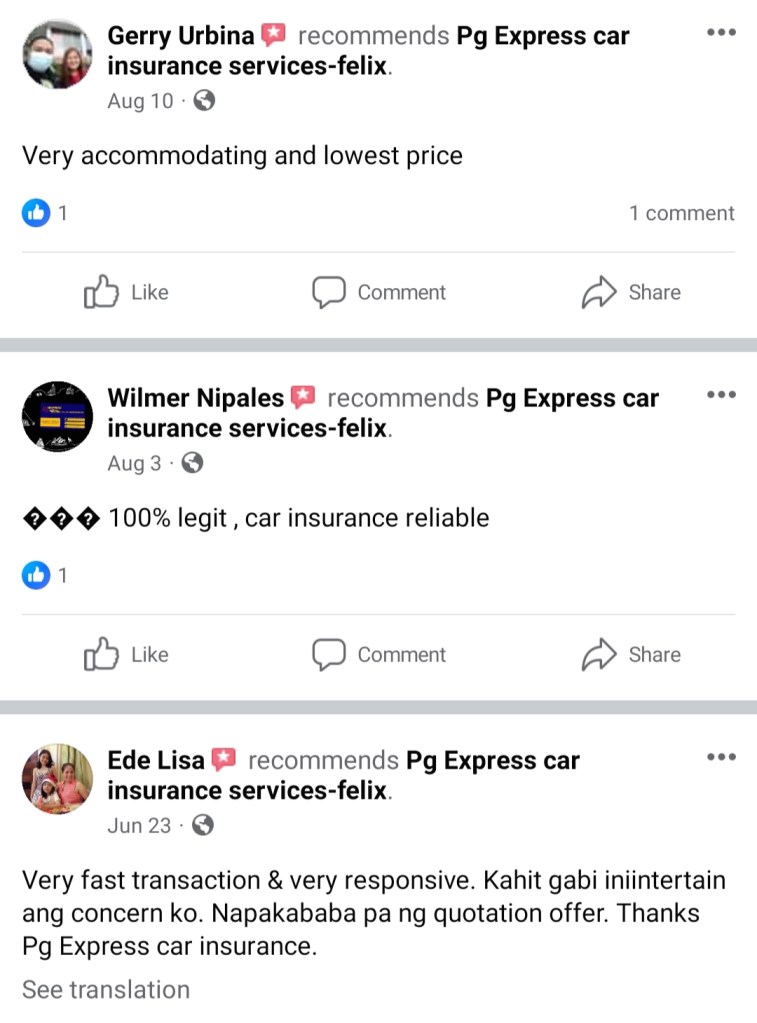

CLIENTS REVIEWS

Case Study A

TESTIMONIALS

Case Study B